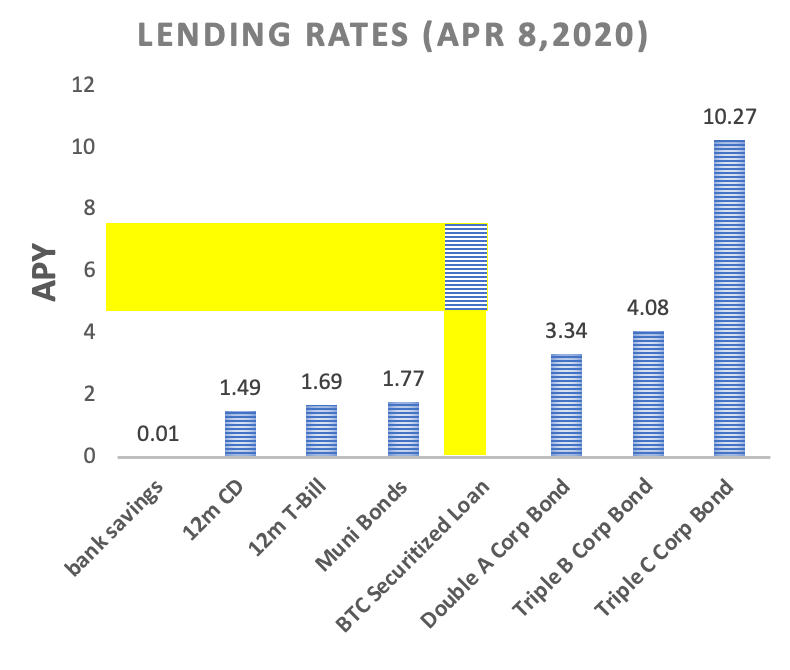

Higher Lending Rates on secured BTC collateral

Use Valuete platform to gain highest lending rates without worrying about the volitility of the Bitcoin market

Get StartedLender Services

Long-term Bitcoin holders represent nearly $300 Billion of unrealized gains. Unlike all other cryptocurrencies, Bitcoin has the most liquid market, the lowest volatility, and most time-tested and mature protocol.

With a Valuete Marketplace monthly subscription, you are granted access to vetted Borrowers seeking USD nominated loans that are overcollateralized with their Bitcoin holdings. Hard LTV limit-triggers are in place to quickly alert and address the borrower of any adverse LTV conditions; and if necessary, to automatically commence the liquidation process far ahead of any highly unlikely lender loss. As backstop, the loan and the conditions associated with the collateral are all 100% enforced by local law.

To get started, simply seek a borrower on the Marketplace that fits your investment thesis and connect using the Valuete web portal to start the loan process. Note, for non-professional Lenders, Valuete provides all the templates for loan and security agreements used to initialize the loan process.

Get Started

Fortress Security

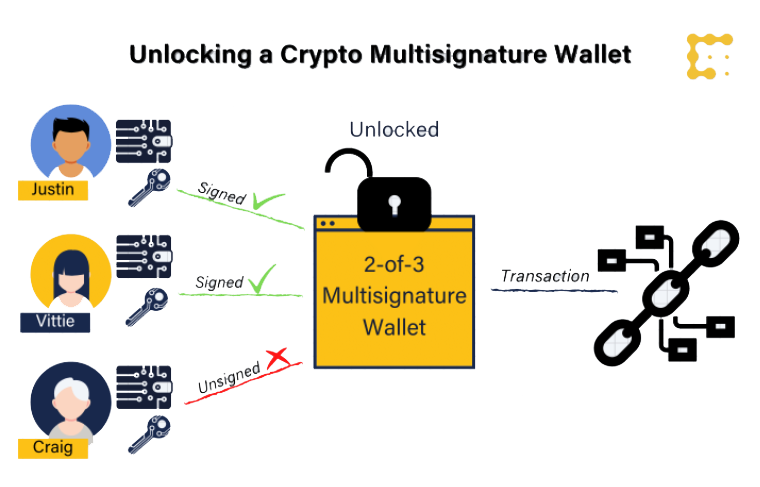

Lender security is provided by multiple layers of security built into the Valuate Vault.

Layer 1

Borrower collateral is transferred into a multi-sig wallet with private keys for by the lender, borrower and Valuete. Collateral access and control require use by 2 of the 3 keys, eliminating any single bad actor risk.

Layer 2

Distributed Class III Offline, Hardware wallets is required by all parties eliminating any risk of online breach

Layer 3

Secure infrastructure, operations, and processes including

- ISO/IEC 27001 Certification

- Community Driven Vulnerability Disclosure & Bug Bounty Program

- 24/7 Security Operations Centres (SOC)

- Immutable audit trails, backups, and retention

- Strong Access Controls, Advanced Data Protection and Crypto Protocols

- Ongoing Risk Assessment, Threat mapping & Auditing

- $150M insurance for third-party theft of private keys in a physical breach of a hardware security module (HSM)

With these layers of Lender protection and pre-set LTV limit triggers on over-collateralized Bitcoin holdings, your loan is nearly free from default and custodial risk.

Loan Calculator

You don’t have to sell your crypto to get cash.

Enter Amount

APR

Loan Duration

Collateral-to-Loan

Collateral Notification At:

Liquidation Response Time:

Force Liquidation At:

0

Collateral

50%

Loan-To-Value Ratio

50%

Initial LTV

67%

Margin Call

83%

Liquidation LTV

APR

6%

Payback

$10000

Interest

$0

How It Works

-

01

Create Account

Simply create a Valuete Lender account

-

02

Search For Borrowers

Start searching interested borrowers that meet your investment requirements

-

03

Execute Security Agreements

Loan initiation can be done completely within the Valuete portal using our lending and security agreements or done outside of the portal using your own loan agreements*.

-

04

Transfer Fund

Borrower adds collateral to MultiSig Wallet and lender transfers funds to the borrower bank account

-

05

Retrieve Funds

As per the loan term, borrower transfers funds/interest to the lender bank account

-

06

Release Colleteral

Once all loan conditions are satisfied by the Borrower and verified by the Lender, the Bitcoin security is returned to the Borrower from the multi-sig wallet.

Because of the uniqueness of this non-custodial security holdings, we do require using the Valuete security interest agreement to assure appropriate Lender protections.

Risk Mitigation Process

We got you covered at each step

Loan Initiation

Loan initiated @50% LTV BTC collateral

Notification of pending Action

LTV @65%, borrower notified

Margin Call

LTV @70% margin required additional collateral or loan pay down in 72 hours

Liquidation of assets

LTV @80% final notice of default, lender reserves right to initial sale of collateral to restore LTV to healthy level